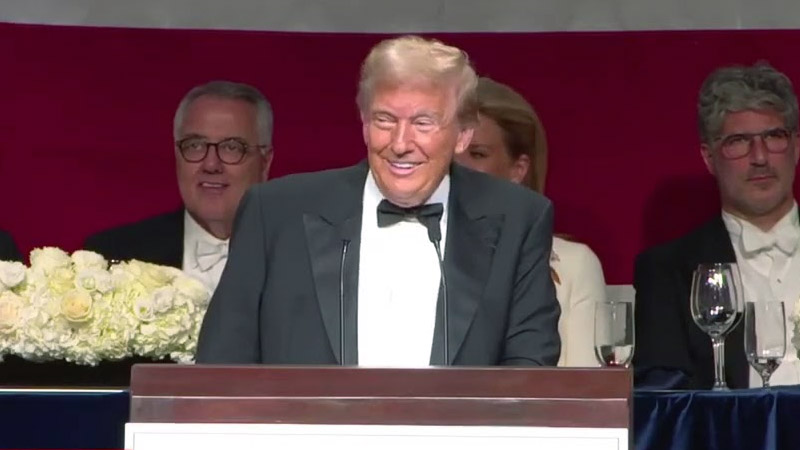

Defense Expert Unveils Surprising Twist in Trump Fraud Trial: Caution Urged in Assessing Financial Statements

Photo Credit: Getty Images

A surprising turn of events has emerged in the ongoing fraud trial involving Donald Trump, as an expert witness for the defense, Jason Flemmons, revealed that lenders should have exercised caution and presumed potential inaccuracies in the former president’s financial statements.

During his testimony challenging the assertions made by Mazars USA accountant Donald Bender, Flemmons emphasized that lenders ought to have heeded signals akin to “buyer beware.” He pointed to what he characterized as “highly cautionary language” in the disclaimers associated with the financial statements.

Reported by ABC News on November 14, Flemmons argued that these disclaimers provided Trump with significant leeway to make claims that deviated substantially from generally accepted accounting principles.

The expert witness specifically criticized Bender and his colleagues at Mazars USA, holding them responsible for any inaccuracies present in the Trump Organization’s financial records.

This revelation introduces a layer of complexity to the trial, prompting inquiries into the reliability of the financial documentation and the accountability of those involved in its preparation.

The core disagreement between Flemmons and Bender centers on the role of appraisals in assessing the accuracy of financial statements. While Bender underscored the importance of appraisals conducted by the Trump Organization in his prosecution testimony, Flemmons argued that lenders should not have relied solely on such appraisals. Instead, they should have paid attention to the disclaimers accompanying the financial statements.

Flemmons contended that the language in the disclaimers should have served as signals for lenders to exercise caution. Interpreting these disclaimers as warnings, he asserted that lenders should have approached the financial information provided by Trump with greater skepticism.

This perspective challenges conventional expectations regarding the responsibility of lenders to scrutinize financial documents and raises questions about the diligence exercised by the accounting firm, Mazars USA, in preparing and presenting these crucial documents.

If the court accepts Flemmons’ testimony, it could reshape the narrative of the trial, intensifying the scrutiny on those overseeing the financial affairs of the Trump Organization. The assertion that lenders should have assumed potential inaccuracies in Trump’s financial statements adds complexity to the ongoing trial, challenging the traditional belief that lenders can rely on provided information without questioning its veracity. This perspective underscores the need for a thorough examination of disclaimers and cautionary language accompanying financial documents, urging lenders to adopt a more vigilant approach.